I saw Paul Ryan on CNN gleefully floating privitizing social security — and, just like when the idea was proposed five years ago and fifteen years ago, the rational is that the stock market in some random time delta has greatly outperformed the investments social security makes.

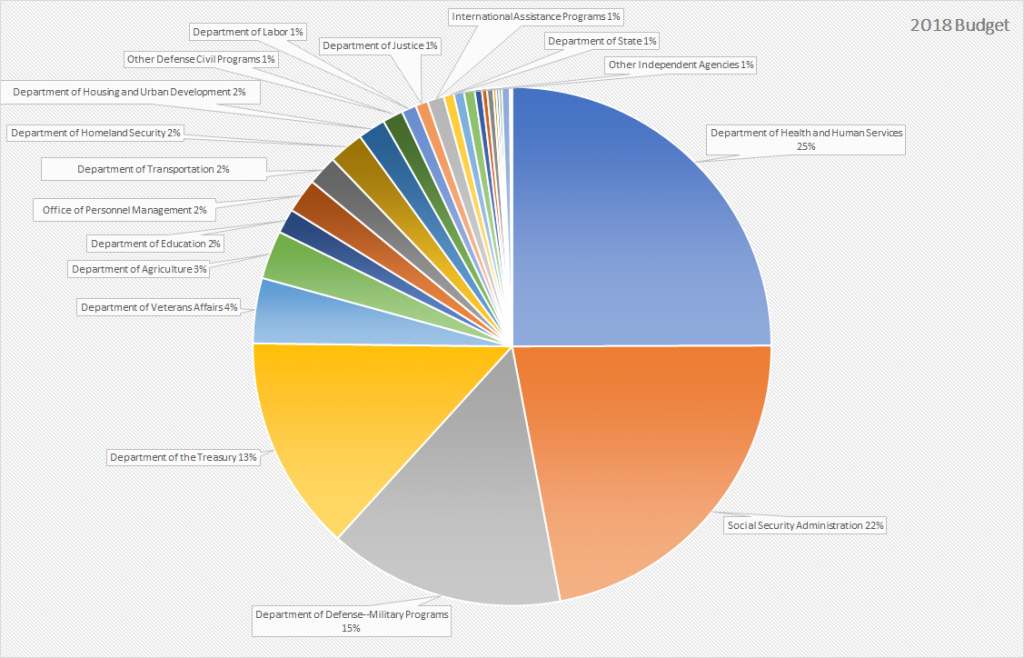

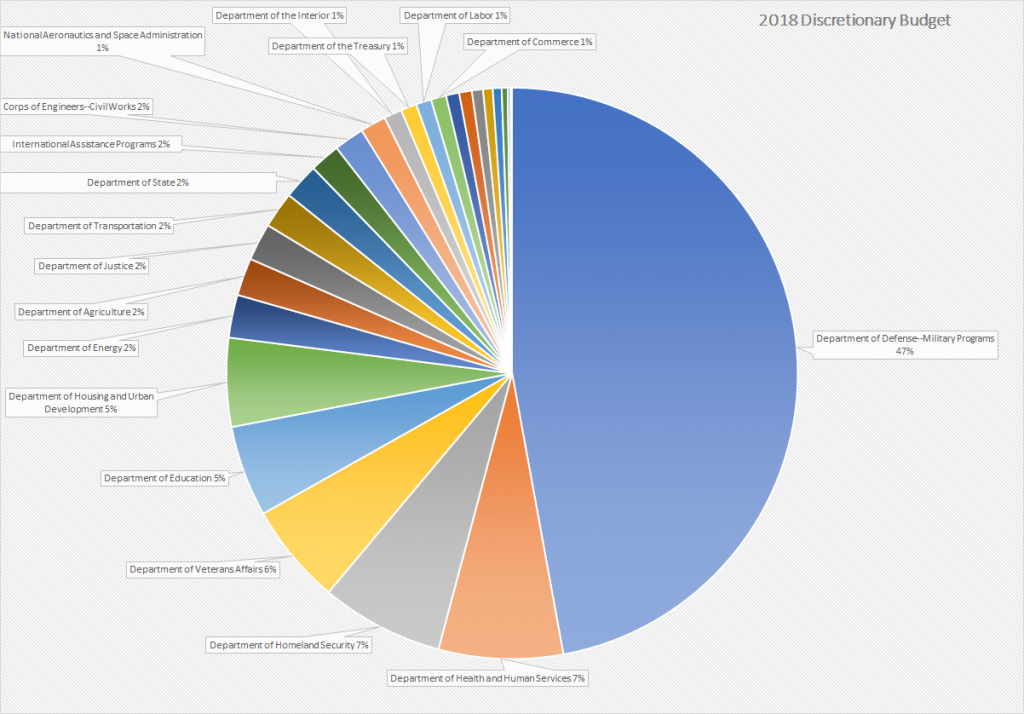

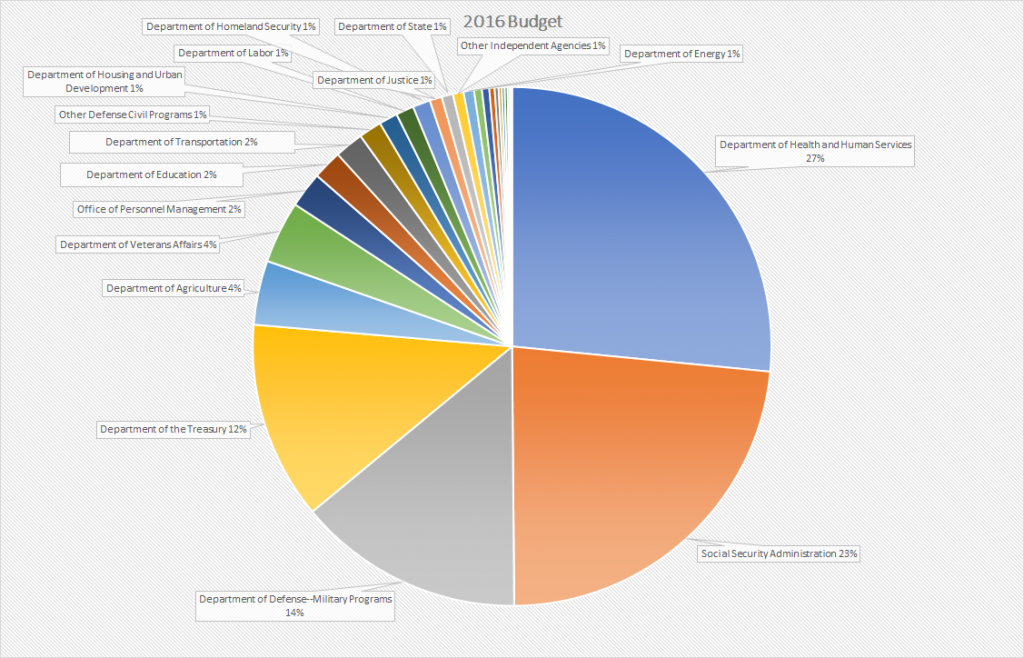

I remember attending a protest when the second President Bush proposed this at the onset of his first term. One of the local news stations had a reporter milling around the protest looking for individuals to interview for the evening news. She asked me leading questions — are you worried about your parent’s retirement if people start investing their social security money in the stock market — and she was surprised that my objection wasn’t anything so specific. The senseless thing about investing social security funds in stocks (or, more likely, in stock funds that also direct a decent chunk of money toward fund managers and investment firms that create those funds) — the whole social security system came into place because people dropped their savings into the stock market, it crashed, and they were broke. It is historically ignorant to avoid mentioning this fact. Social security forces people to make *some* safe investment choices. Yes, those have lower yields … but they also don’t LOSE money. If you earn enough money to have extra and want to invest it in DWAC or bitcoin or stuff it under your mattress … rock on! But don’t pretend that we’re not getting any benefit of the lower yield investments made with the social security trust money. Also, how in the world is our government funded after all this social security money starts flooding the stock market … the social security trust money is going into special Treasury bonds. Even if 20% of those funds got redirected into investment funds (and that’s a HUGE boon to fund managers, just like 401k’s were a huge boon to fund managers), that’s a lot of money *not* going into US Treasuries anymore.

I will note, too — directing a large pool of money into the stock market would, in the short term, re-inflate stock prices and allow current investors to make a lot of money.